Do you know how Artificial Intelligence (AI) can impact the financial sector?

Well, the finance domain has always been about analyzing data to predict risks and give insights into more revenue opportunities. Dealing with vast amounts of data, the financial services industry poses limitations to human analysis, this is where AI comes into play. According to a report published by EMERGEN Research, by 2027 the global AI in banking is expected to reach $130 billion. Not just this, but the adoption rate of AI in the financial services sector is maturing at a rapid pace, as banks are implementing it across a range of innovative uses. Another research by the International Monetary Fund (IMF) states that financial institutions are forecasted to double their spending on AI by 2027. These numbers indeed are intriguing and give a clear hint about the impact AI can make in this sector.

As we move ahead into 2024, the integration of AI in finance continues to amaze the entire financial sector, with the introduction of newer technologies and applications that are reshaping the industry landscape. Revolutionizing the sector in several ways right from automating routine tasks to detecting complex patterns, AI runs through millions of data points generating insights that are beyond human capabilities. When applied ethically, AI in the financial domain can go a long way by expanding access to credit and financial tools. So, in a world that is full of complexities and vast amounts of data, AI can be deployed as the driving force for better fiscal management. Given the impact AI is making in different sectors, our blog is mindfully put together to share insights on AI-driven innovations and trends in the financial services sector.

Let us now delve into the adoption of AI in the Finance sector and the key AI trends in Financial services.

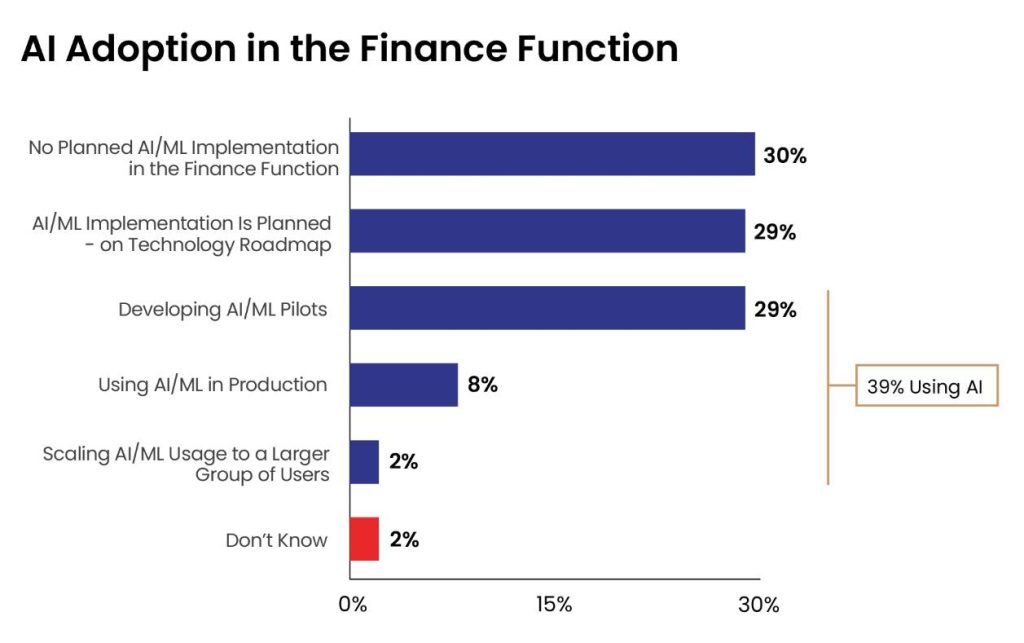

According to a recent survey led by Gartner, 39% of financial organizations are already using AI or plan to use this technology. The survey also shares insights on the percentage of using AI/ML, where 29% of respondents state they are already using the technology, and 29% plan to use it as depicted in Figure 1.

In the bigger picture, we can say that the adoption of AI in the financial services sector is catching pace. Another important statistic shared by E&Y states that around 99% of the respondents surveyed agree that they are deploying AI in some form or the other, signaling the adoption of AI in finance.

Ever wondered why there is an increase in the adoption of AI in Financial services?

It might sound metaphorical, but AI in the financial sector is paying rich dividends by making a significant difference. With AI at the forefront, the financial sector is taking on the market head-on by fostering innovative ways to meet customer demands. The inclusion of AI in financial operations can incredibly support the financial sector. The adoption of AI at this point might seem a little slow, but in the current situation, the sector is progressively embracing this technology to lead to a brighter future.

AI has been a key driver behind the emergence of technologies such as blockchain, big data analytics, robotics, Internet of Things (IoT), and Robotic Process Automation (RPA) within the financial sector. These advancements are transforming finance by enhancing efficiency, enabling smarter decision-making, improving risk management, and creating new opportunities for innovation and growth.

Below are reasons why AI is getting popular within the financial sector:

Cost Saving: AI in the financial services sector can be deployed to reduce or control manual errors with the help of algorithms. These algorithms also help in automating repetitive tasks leading to cost savings, by controlling operational expenses.

Revenue Growth: AI in finance can be optimistically used to design and develop financial products that are well accustomed to changing customer needs and demands leading to a strong product portfolio that can attract better gains and improve revenue streams.

Enhanced Risk Management: When it is the question of risk management AI/ML has been identified as one of the best possible solutions. Possessingstrong analytical abilities, and the capacity to analyze large volumes of unstructured data, AI in finance can track down complexities and manage risks more efficiently, while eliminating losses, and improving the profitability quotient for financial institutions.

Let’s explore the AI-driven innovations supporting the Financial Sector

As we are halfway through 2024, the current market trends and the need to adopt and implement advanced technology make it imperative for financial organizations to stay updated. To enhance the operations and performance of the financial sector, AI-assisted innovations and solutions play a vital role. Some of the key AI-driven innovations are listed below.

Chatbots/Virtual Assistants

Financial institutions are deploying AI-driven innovations such as chatbots and virtual assistants to deliver elevated customer experience. These AI-powered systems are developed to cater to a range of customer issues or queries related to account information, questions, and other financial guidance. Designed to comprehend and respond to what the customer wants by making the best possible use of natural language processing and machine learning techniques, these tools power improved customer satisfaction.

Advanced Fraud Detection

The financial sector is one of the most sensitive domains that demands heightened security. Real-time transactional data analysis undertaken by AI algorithms possesses the capability to identify suspicious trends or abnormalities that signal fraud. These algorithms may incessantly keep track of new fraudulent tendencies by deploying machine learning techniques, that further enhance their detection capacities.

Risk Management

AI in the financial sector offers sector-specific privacy and algorithmic bias challenges. According to the International Committee on Credit Reporting (ICCR), there are several risks associated with credit scoring models, such as data inaccuracies, data that is collected without customer consent, and more that lead to high exposure to cyber risks. On the bright side, by using AI these risks are fed back into the systems to improve decision-making. Additionally, early adopters of this technology can deploy larger data sets on which algorithms can further be trained and enhanced to get a more refined output, to help financial organizations better mitigate potential impacts.

RegTech and Compliance

RegTech or regulatory technology is known as one of the most powerful tools in the financial sector, as it aids businesses to revolutionize the management of regulatory compliance. Advanced and budding technology like AI, cloud and big data have refined RegTech solutions to help financial institutions automate compliance processes and reduce the risk of penalties due to non-compliance issues.

Investment & Trading

Investment and trading are two very important aspects of the financial sector, and we cannot deny it is changing due to the emergence of AI adoption. AI tools in this realm of finance increase efficiency by removing the human emotion quotient from decision-making. AI technologies like Natural Language Processing (NLP), deep learning, and ML analyze large volumes of data to identify patterns that human intelligence might find difficult to detect. Trading in global markets is now more readily available because AI algorithms can work 24/7, creating opportunities in different time zones. Risk management inclusions work positively towards protecting traders from making misinformed decisions based on bias, fatigue, and emotions.

To gain more insights on how AI-based solutions can solve pressing business challenges irrespective of the industry, read our blog on Enterprise AI Platforms.

Setting the stage right, Generative AI is expected to be one of the most impactful trends entering the financial services sector this fiscal year. Right from reshaping customer experience, to introducing highly efficient wealth management tools, the financial sector has a lot to do with technology. So, without any further ado, let’s find out what’s trending!

Generative AI

Generative AI or Gen AI is one of the most talked about and adopted technology trends in almost every sector and finance is no exception. It is making a significant difference in the way financial corporations are managing their operations and strategies. This year with the increasing influence of FinTech, the application of Gen AI and chatbots is expected to grow.

By leveraging advanced AI models and algorithms, businesses are automating and optimizing financial tasks including budgeting, risk management, and forecasting. It is also essential to understand that AI can process real large amounts of data accurately and efficiently and aid in identifying anomalies, potential risks, and trends.

Along with this, the proper use of Gen AI can open an entire world of innovations that can support personalized financial planning and investment management, making it a driving force responsible for positive change throughout the industry.

Cybersecurity and Risk Management

The amount of good AI and generative AI brought to the financial sector also poses challenges about cyber risks. As technological advancements take place at a rapid pace, the chance of cybersecurity increases simultaneously. To take charge of such situations while embracing the goodness of booming technology, financial institutions must aim for zero-trust architecture keeping in mind that security misconfiguration and issues associated with traditional systems might increase the chances of data loss and hurt the reputation of the business. Therefore, no matter what trend you are following, staying abreast of security is a must.

Sustainability

The interconnected nature of global finance and sustainability is gaining attention. Until now businesses were primarily focused on profits, but with depleting natural resources, and increasing carbon footprint, there is increasing pressure for financial institutions to take an active part in green investments that include renewable energy, recycling, and more.

Digital Currencies

Digital currencies are booming and have the potential to transform the financial sector. The fast-growing popularity of the new era of currency can be associated with factors such as a reduction in operational costs involved in physical cash management, faster payments, and more. The inclusion of digital currency eliminates the socio-economic barrier and challenges that are associated with physical banking infrastructure, making the shift towards a cashless economy the thing of the future.

Now that we are aware about what’s trending in the financial sector, it is once again time to go back to AI and understand its different uses in the financial sector.

AI in the financial sector has changed the way the world deals with money. By providing millions of people with 24/7 access to bank accounts, better trading forecasts, and fast and easy operations, AI has changed the face of finance for the better. Generative AI, a booming technology, is also taking the financial industry by storm by opening newer vistas of financial services institutions to explore.

As depicted in the image above, let us quickly understand what these elements are trying to explain:

Financial services companies have been positive about embracing automation for some time. However, these businesses can thrive through “intelligent process automation” and unlock improved revenue, efficiency, and risk management by combining the power of Robotic Process Automation, AI, and human intelligence. These approaches help gain full digitalization of processes and systems.

Implementing AI and ML in financial processes can help detect any abnormalities and work towards the prevention of fraudulent activities. By analyzing large data sets, AI models can be effectively deployed to identify unusual patterns with more accuracy. By analyzing transaction data, AI models can identify unusual patterns, such as sudden changes in transactions or location-based anomalies aiding the financial sector to be more prepared and prompter in catering to fraudulent activities while minimizing financial losses.

Analytics in finance works continuously in the direction of improving performance, boosting income, and developing strategies that could pass past clever selection-making. By deploying analytics, monetary institutions can benefit from treasured insights into essential components consisting of patron behavior, operational efficiency, and marketplace developments. By using these statistics within the great viable way economic institutions are in a higher role to make greater informed selections, enhance the first-class of services, and customize the financial merchandise portfolio to effectively meet patron wishes and needs.

Intelligent use of AI in finance can improve operational efficiency and support day-to-day operations. AI-powered gear can perform habitual duties, together with records access and processing, allowing personnel to pay attention to strategic planning. Additionally, AI can resource in selection-making by supplying actual-time insights and guidelines, creating a widespread difference in the pace and accuracy of processing This enhancement of human talents outcomes in an agile organization and efficient, able to swiftly adapt to marketplace fluctuations.

As time passes and advanced technologies like AI, Generative AI, Deep Learning and ML take the lead, the financial sector slowly but steadily is getting in the race. By generating synthetic data, automating processes, and improving decision-making, these technologies support the financial sector to overcome a plethora of challenges and gain a competitive advantage. In the past few years, the financial sector has displayed resilience in the adaptability of AI, but the statistics shared above showcase shed light on how businesses are now adopting this booming technology for a wide range of reasons.

Calsoft being one of the early adopters of AI and generative AI, has helped several businesses gain a competitive edge in the market by delivering robust, scalable, and reliable solutions. Our Gen AI, Data, and ML offerings help businesses solve their biggest challenges.